JAPANESE CANDLESTICK CHARTING TECHNIQUE

Last updated on: June 04, 2024

The term "candlesticks" also called "candles" is a Japanese chart

analysis technique that has been refined by generations of use in

the Far East. Until 1991, the technique remained secret from the

Western world for over a century because no document ever mentioned

about it. But, now it is known and accepted worldwide. Some of the

features of this technique are:

- Easy to understand

- Provide earlier indications of the market turns and reversal

signals

- Furnish unique market insights by showing the underpinning

move

- Enjoyable to learn

- Applicable to any market be it Eastern or Western and enhances

analysis

- Increases the effeciency of analysis by sending visual

information

- Based on psychology of market - considers sentiments of

traders

Traditional Bar charts vs Candle charts

|

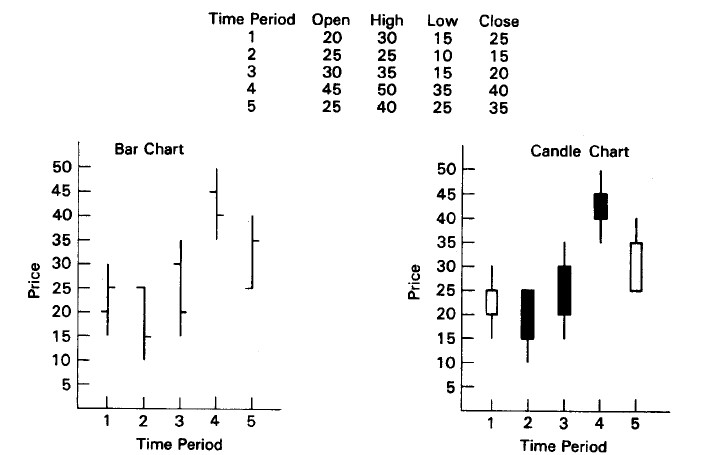

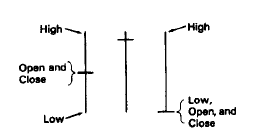

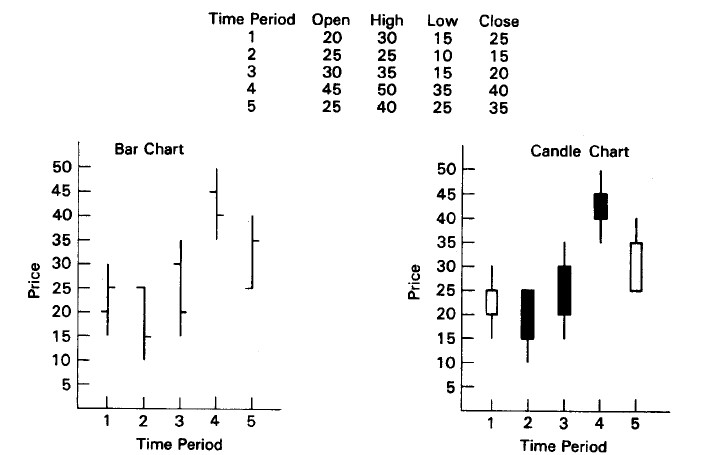

The image on the right side shows a table at the top

which shows open, close, high and low values for 5

periods. The Bar chart and the Candle chart for this

data are shown below this table.

The bar chart for a period has a vertical line which

shows the high and the low values for the day. The

horizontal line on the left-side of the vertical line

shows the open and the horizontal line on the right of

the vertical line shows the close.

The explanation for candlesticks is present in the

following section.

|

0

|

The basics of candlesticks

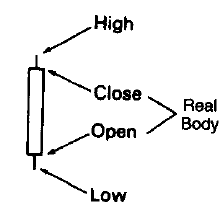

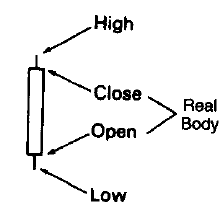

Candle - A candle has a real body which is the rectangular

section and thin lines above and below the real body called shadows.

The top and the bottom sections of the rectangular body represent

the open and the close values and the tips of shadows represent

the high and the low values. Because of their shape these are

called candles. Candles can be drawn using any time frame- from

intraday to daily to weekly charts and so on. Multiple variants

of candle are shown below:

|

The white candle - when the close value is greater than

the open value then this is depicted as a white candle.

This is also called bulls.

|

White candle

|

The black candle - when the open value is greater than

the close value then this is depicted as a black candle.

This is also called bears.

|

Black candle

|

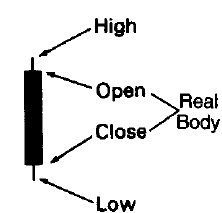

Shaven head- If a candle has no upper shadow, it is said

to have shaven head.

Shaven bottom- A candle with no lower shadow has a shaven

bottom.

Spinning top- The japanese term for a small real body

(black or white) is a spinning top.

|

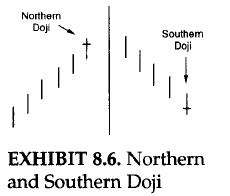

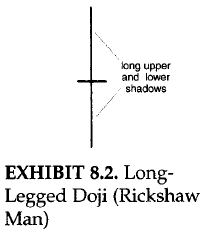

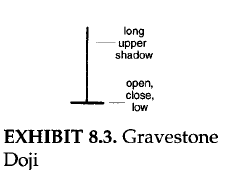

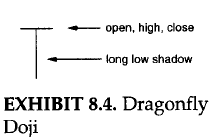

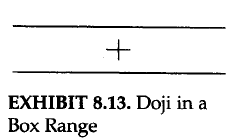

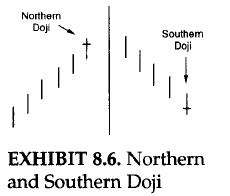

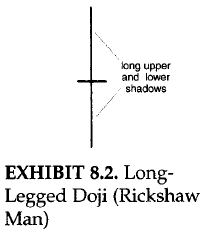

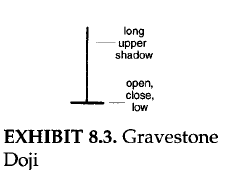

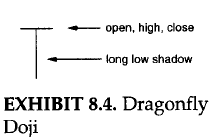

Doji- When there are no real body i.e. when the

open and close values are really close then the candles

representing these are called doji. The plural of doji is

doji.Doji have implications as a reversal signal.

|

Doji

|

Python code for candlestick pattern recognition

- The dataset contains daily information of share such as Open, Close, High and Low.

- Conservative approach for estimating support or resistance is chosen.

- Libraries required: talib, numpy, pandas, matplotlib.pyplot and mplfinance.

- TA-Lib library used for pattern recognition.

- In windows environment, TA-lIB installation is required.

Python code

import talib

import numpy as np

import pandas as pd

import matplotlib.pyplot as plt

import mplfinance as mpf

plt.style.use('ggplot')

path_for_data_file = "absolute path for file"

data_from_file = pd.read_csv(path_for_data_file)

data_from_file['Date'] = pd.to_datetime(data_from_file['Date'], format="%d-%m-%Y")

data_from_file.index = pd.DatetimeIndex(data_from_file['Date'])

refined_data = data_from_file[(data_from_file.Date > '1998-02-01') & (data_from_file.Date < '1998-05-30')]

mpf.plot(refined_data, type='candle', mav=(3, 6, 9))

def pattern_recognition(data):

data['remarks'] = None

data['support'] = None

data['resistance'] = None

trend_reversal(data)

less_powerful_trend_reversal(data)

continuation_pattern(data)

doji_reversal_indicator(data)

pattern_recognition(data_from_file)

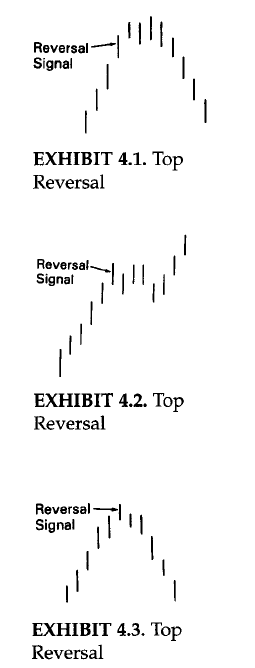

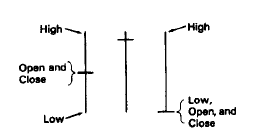

Trend reversal

|

Trend reversal means that the prior trend is about to

end. This is shown in the figure on the right side of

this section. The indicators have indicated that the upward

movement is about to end. And now one of the three situation

may happen:

-

The price will continue to move up a bit and then it

will move down.

-

The price will move down and after reaching a point, it

will rise again.

-

The price will fall and continue to fall.

Trend reversal is just a caution indicator. The market's

psychology is in transformation. The same is applicable for downtrend as well.

|

Trend reversal

|

Python code

def trend_reversal(data):

hammer_pattern(data)

hangingman_pattern(data)

bullish_engulfing_pattern(data)

bearish_engulfing_pattern(data)

dark_cloud_cover(data)

piercing_pattern(data)

morning_star(data)

morning_doji_star(data)

evening_star(data)

evening_doji_star(data)

shooting_star(data)

inverted_hammer(data)

doji_star_support(data)

doji_star_resistance(data)

abandoned_baby_top(data)

abandoned_baby_bottom(data)

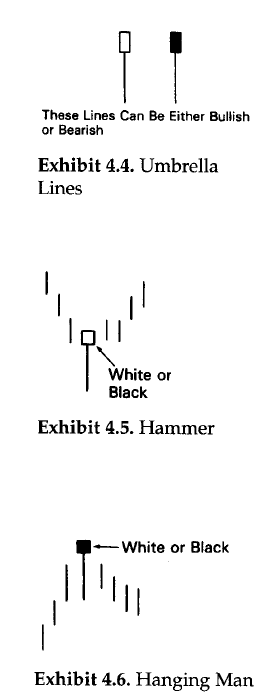

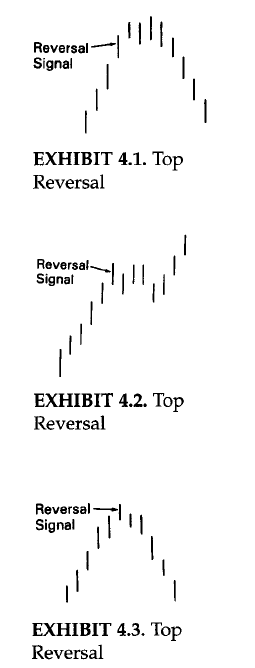

UMBRELLA LINES

-

Candles with long lower shadows and small real bodies

(black or white) near the top of the range. These are

called umbrella lines because they look like umbrellas.

-

These umbrella lines can be either bullish or bearish

according to the market environment. The character of

umbrella lines changes based on the prevailing trend before

the umbrella lines.

-

If an umbrella line emerges during a downtrend, it is

a signal that the downtrend should end. In such a scenario,

this umbrella line is labeled a hammer, as in "the

market is hammering out" a base.

-

The actual Japanese word for the hammer is takuri.

The hammer line looks like a hammer with its head and handle.

The hammer's long lower shadow and the close at, or near, the

high of the session graphically relays that the market sold off

sharply during the session and then bounced back to close at, or

near, the session's high. this could have bullish ramifications.

This aspect of closing at or near highs is why the hammer should

have no, or a miniscule, upper shodow. If there was a long upper

shadow, this would mean the market closed well off its highs,

which is an important criterion for the hammer. A lower shadow

is necessary because it would display that the market had been

pushed downsharply lower during the session, but by the end

of the session, there was a "kamikaze fight" as the bears lost

controls is depicted by the fact that the market closed at, or near,

its session highs.

-

One interesting aspect, a very long shadow hammer means that by the time the hammer is confirmed (we need to wait for a close to confirm

the hammer), the market could be well off its lows. Buying at the close of such a hammer may not present an attractive risk/reward since

the market may retrace back to the lows of the hammer before, potentially, resuming an upward course. A high-volume hammer decreases the

chance for a correction to the hammer's low. Therefore, one may be more aggressive about buying on the hammer's close if it is a usually

high-volume hammer than one would if the volume didn't give the same forceful confirmation.

-

If either of lines emerges after a rally, it is a potential

top reversal signal called a hanging man. The name

"hanging man" is derived from the fact that it looks like a

hanging man with dangling legs. It has the same shape as the

hammer. The only difference is that a hanging man comes after

an advance. A close beneath the hanging man is preffered.

It is advisable to wait for bearish confirmation after

a hanging man.

-

The colour of the the real body does not make any difference.

The hammer and hanging man can be recognized by three

criteria:

-

The real body is at the upper end of the trading range.

The colour of the real body is not important.

-

It has a long lower shadow that should be at least twice

the height of the real body.

-

It should have no, or a very short, upper shadow.

There are three aspects that differentiate the hanging man

from hammer- trend, extent of the move before the candle line,

and the confirmation.

-

Trend: A hammer must come after a decline. A hanging man

must come after a rally.

-

Extent of the move before the candle line: A hammer is valid

even if it comes after a short-term decline, but a hanging man should

emerge after an extended rally, preferably at an all-time high.

-

Confirmation: A hanging man should be confirmed, while a

hammer need not be.

The longer the lower shadow, the shorter the upper shadow; the

smaller the real body, the more meaningful the bullish hammer or

bearish hanging man.

|

Umbrella Lines

|

Python code

def hammer_pattern(data):

hammer = talib.CDLHAMMER(data.Open, data.High, data.Low, data.Close)

data.loc[(hammer == 100) & (data['remarks'].isna()), 'remarks'] = 'hammer'

data.loc[(hammer == 100) & (data['support'].isna()), 'support'] = data.loc[hammer == 100, 'Low']

def hangingman_pattern(data):

hanging_man = talib.CDLHANGINGMAN(data.Open, data.High, data.Low, data.Close)

data.loc[(hanging_man == -100) & (data['remarks'].isna()), 'remarks'] = 'hanging_man'

data.loc[(hanging_man == -100) & (data['resistance'].isna()), 'resistance'] = data.loc[hanging_man == -100, 'Low']

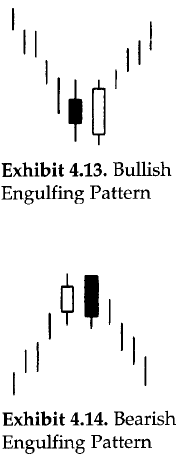

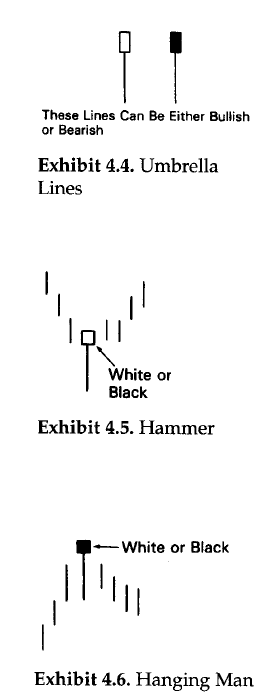

THE ENGULFING PATTERN

-

Most candle signals are based on combinations of

individual candle lines. The engulfing pattern is

the first of these multiple candle line patterns.

-

The engulfing pattern is a major reversal signal

with two opposite colour real bodies composing a

pattern.

-

Another name for the engulfing pattern is a "hugging

line".

-

The figure shown on the right (above) of this section

shows a bullish englufing pattern. The market

is falling. And then a white bullish real body wraps

around, or engulfs, the prior period's black real body.

This shows buying pressure has over-whelmed selling

pressure.

-

The figure shown on the right (below) of this section

shows a bearish engulfing pattern. Here the

market is trending higher. A white real body engulfed

by a black real body is the signal for a top reversal.

This also shows that supply has overwhelmed demand.

-

The significance of the bearish engulfing pattern will increase if there is a lighter volume on the first candle (the white) and a

heavier volume on the second candle (the black).

There are three criteria for an engulfing pattern:

-

The market has to be in a clearly definable uptrend

(for a bearish engulfing pattern) or downtrend (for

a bullish englufing pattern), even if the trend is

short term.

-

Two candles comprise the engulfing pattern. The second

real body must engulf the prior real body (it need not

engluf the shadows).

-

The second real body of the engulfing pattern should be

the opposite colour of the first real body. The exception

to this rule is if the first real body of the engulfing

pattern is a doji. Thus, after an extended fall, a doji

engulfed by a very large white real body could be a bottom

reversal. In an uptrend, a doji enveloped by a very large

black real body could be a bearish reversal pattern.

Some factors increasing the likelihood that an engulfing

pattern could be an important turning signal are:

-

If the first day of the engulfing pattern has a very small

real body (i.e., a spinning top) and the second day has a

very long real body. The small first real body candle

reflects a dissipation of the prior trend's force and the

large second real body proves an increase in the force

behind the new move.

-

If the engulfing pattern appears after a protracted or very

fast move. A fast or extended move creates an overextended

market (either overbought or oversold) and makes it vulnerable

to profit taking.

-

If there is heavy volume on the second real body of the

engulfing pattern.

|

Engulfing Pattern

|

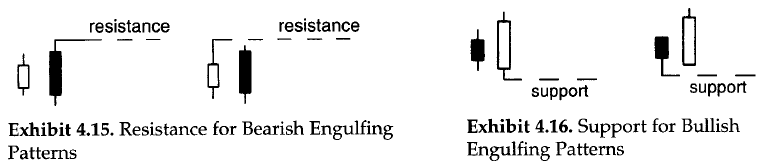

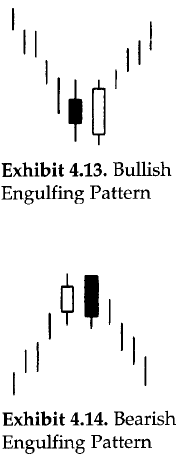

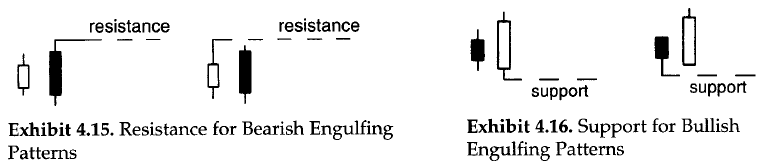

Resistance or Support for Engulfing Patterns

-

A prime use of the engulfing pattern is utilizing them as support

or resistance. Provided we need to wait for the close.

-

On the right hand side of the figure shown above, the high of the

two candle lines that make the bearish engulfing pattern. That high

becomes our resistance (based on a close).

-

This technique of the bearish engulfing pattern as resistance is

especially useful if the market has moved too far from the highs

to be comfortable selling.

-

On the left hand side of the figure shown above, the same concept is

used for bullish engulfing pattern. The lowest low of this pattern

becomes support.

-

This technique of the bullish engulfing pattern as support is

especially useful if the market has moved too far from the lows

to be comfortable buying (consider correction as well).

Python code

def bullish_engulfing_pattern(data):

bullish_engulfing = talib.CDLENGULFING(data.Open, data.High, data.Low, data.Close)

data.loc[(bullish_engulfing == 100) & (data['remarks'].isna()), 'remarks'] = 'bullish_engulfing_pattern'

data.loc[(bullish_engulfing == 100) & (data['support'].isna()), 'support'] = data.loc[bullish_engulfing == 100, 'Low']

def bearish_engulfing_pattern(data):

bearish_engulfing = talib.CDLENGULFING(data.Open, data.High, data.Low, data.Close)

data.loc[(bearish_engulfing == -100) & (data['remarks'].isna()), 'remarks'] = 'bearish_engulfing_pattern'

data.loc[(bearish_engulfing == -100) & (data['resistance'].isna()), 'resistance'] = data.loc[bearish_engulfing == -100, 'Low']

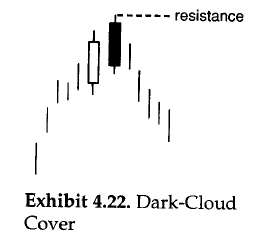

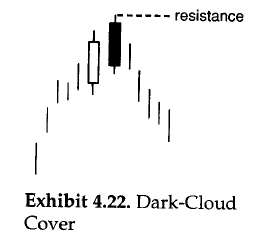

DARK-CLOUD COVER

-

It is a reversal pattern. It is a dual-candle pattern

that is a top reversal after an uptrend or, at times,

at the top of a congestion band.

-

The first day of this two-candle pattern is a strong white

real body. The second day's price opens above the prior

session's high (that is, above the top of the upper shadow).

However, by the end of the second day's session, the market

closes deeply within the prior day's white body.

-

The greater the degree of penetration into the white body, the

more likely this is a top. Some Japanese technicians require

more than a 50-percent penetration of the black session's close

into the white real body.

-

If the black candles does not close below the halfway point

of the white candlestick, it may be best to wait for more

bearish confirmation following the dark-cloud cover.

-

In some cases it is considered as a

dark-cloud cover even if the open is over the prior session's

close instead of the prior session's high.

-

The rationale behind this bearish pattern is readily explained.

On the first session of the dark-cloud cover, the market is

ascending with a strong white candle. This is followed by a gap

higher on the next session's opening. Thus far, the bulls are in

complete control. But then the whole technical picture changes as,

on the second day of this pattern, the market closed not only

beneath the prior close, but well within the prior day's real body,

offsetting much of the gain of the first session. In such scenario,

the longs will have second thoughts about their position.

-

Those who were waiting for selling short now have a benchmark to

place a stop at the new high of the second day of the dark-cloud

cover pattern.

-

Just as a bearish engulfing pattern can be resistance, so too the

highest high of the two sessions that formed the dark-cloud

cover should be resistance.

|

Dark Cloud Cover

|

Some factors intensifying the importance of the dark-cloud covers include:

-

The greater the penetration of the black real body's close into the

prior white real body, the greater the chance for a

top. If the black real body covers the prior day's entire white

body, it would be a bearish engulfing pattern rather than a dark-cloud

cover. A bearish engulfing pattern, consequently, can be a more

meaningful top reversal. If a long white real body closes above the highs

of the dark-cloud cover, or the bearish engulfing pattern it could

indicate another rally.

-

During a prolonged ascent, if there is a strong white day that opens

on its low (that is, a shaven bottom) and closes on its high (that is,

a shaven head) and the next day reveals a long black real body day,

opening on its high and closing on its low, then a shaven head and

shaven bottom black day has occurred.

-

If the second body (i.e., the black body) of the dark-cloud covers

opens above a major resistance level and then fails, it would prove

the bulls were unable to take control of the market.

-

If on the opening of the second day, there is very heavy volume,

then a buying blow off could have occurred. For example, heavy volume

at a new opening high could mean that many new buyers have decided to

jump abroad ship. Then the market sells off. For future traders,

very high opening interest can be another warning.

Python code

def dark_cloud_cover(data):

dark_cloud_cover = talib.CDLDARKCLOUDCOVER(data.Open, data.High, data.Low, data.Close)

data.loc[(dark_cloud_cover == -100) & (data['remarks'].isna()), 'remarks'] = 'dark_cloud_cover'

data.loc[(dark_cloud_cover == -100) & (data['resistance'].isna()), 'resistance'] = data.loc[dark_cloud_cover == -100, 'Low']

# print(data[dark_cloud_cover == -100])

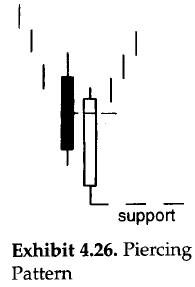

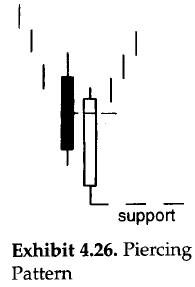

PIERCING PATTERN

-

The dark-cloud cover's counterpart is the bullish piercing

pattern. The piercing pattern is composed of two candles in

a falling market.The first candle is a black real body day

and the second is a white real body. This white candle opens

lower, ideally under the low of the prior black day. Then the

prices rebound to push well into the black candle's real body.

|

Piercing pattern

|

-

The piercing pattern is similar to the bullish engulfing pattern.

In the bullish engulfing pattern, the white real body engulfs the

entire previous black real body. For the piercing pattern, the

white real body pierces, but does not wrap around, the prior black

body.

-

In the piercing pattern, the greater the degree of penetration into

the black real body, the more likely it will become a bottom reversal.

An ideal piercing pattern will have a white real body that pushes more

than halfway into the prior session's black real body. The psychology

behind the piercing pattern is as follows:

-

The market is in a downtrend. The bearish black real body reinforces

this view.

-

The next session the market opens lower via a gap. The bears are watching the

market with happiness.

-

Then the market surges toward the close, managing not only to close unchanged

from the prior day's close, but sharply above that close. The bears will be

second-guessing their position.

-

Those who are looking to buy would say new lows could not hold and could view

it as an opportunity to buy.

-

The piercing pattern signal increases in importance based on the same factors

1 through 4 as with the dark-cloud cover, but in reverse.

-

With the dark-cover we would like to see the black real body closing more than

midway in the prior white candlestick. But there is some flexibility to this rule.

There is less flexibility with the piercing pattern. The piercing pattern's white

candlestick should push more than halfway into the black candlestick's real body.

-

The reason for less latitude with the bullish piercing pattern than with the bearish

dark-cloud cover pattern is the fact that the Japanese have three other patterns

called the on-neck, the in-neck, and the thrusting pattern.

-

All three have same basic formation as the piercing pattern. The difference among them

is in the degree of penetration by the white candle into the black candle's real body.

-

The on-neck pattern- The on-neck pattern's white candle (usually a small one)

closes near the low of the previous session.

-

The in-neck pattern- The in-neck pattern's white candle closes slightly into

the prior real body (it should also be a small white candle).

-

The thrusting pattern- The thrusting pattern should be a longer white candle that

is stronger than the in-neck pattern, but still does not close above the middle of the

prior black body.

-

The general concept that one should view a non-ideal candle pattern by:

-

How it was formed

-

Within the overall market picture

These two factors will help us gauge if the less-than-perfect pattern could have

the same implications as a more classicly defined candle pattern. It is the

subjectivity that makes computer recognition of candle patterns so difficult.

-

With the piercing pattern, we would like to see lighter volume on the black candle and heavier volume on the white candle.

This would serve to reinforce that the bears are loosing force and the bulls are gaining a strong foothold. This volume

scenario also increases the odds that the piercing pattern will hold.

|

More of piercing pattern

|

Python code

def piercing_pattern(data):

piercing_pattern = talib.CDLPIERCING(data.Open, data.High, data.Low, data.Close)

data.loc[(piercing_pattern == 100) & (data['remarks'].isna()), 'remarks'] = 'piercing_pattern'

data.loc[(piercing_pattern == 100) & (data['support'].isna()), 'support'] = data.loc[piercing_pattern == 100, 'Low']

# print(data[piercing_pattern == 100])

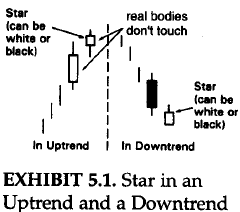

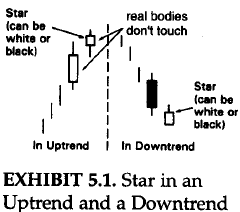

STARS

-

A star is a small real body (white or black) that

gaps away from the large real body preceeding it.

-

In other words, the star's real body can be within

the prior session's upper shadow. All that is needed

is that the real bodies don't operlap (there are some

exceptions to this rule, which are addressed later in

this section).

-

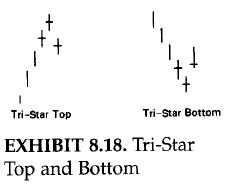

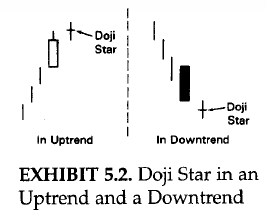

If the star is a doji instead of a small real body, it

is called doji star. The star, especially the doji star,

is a warning that the prior trend may be ending.

-

The star's small body represents a stalemate between the

bulls and bears. The bulls are obviously in charge in a

brisky ascending market.

-

With the emergance of a star in such an environment, it is

a signal of a shift from buyers being in control to a

deadlock between the buying and selling forces. This

deadlock may have occurred either because of a diminution

in the buying force or an increase in the selling pressure.

Either way, the star tells us the rally's prior power has

slightly dissipated. This means the market is vulnerable to

a setback.

|

Star

|

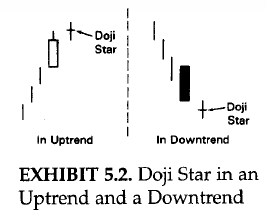

Doji star

|

|

|

|

-

The same is true, but in reverse, for a star in a downtrend

(sometimes a star during a downtrend is labeled a raindrop).

The long black candle during the downtrend visually reflects

that the bears are in command. A change is seen in the advent

of the star, which signals as environment in which the bulls

and the bears are more in equilibrium. In other words, the

downward energy has thus been cooled. This is not a favourable

scenario for a continuation of the bear market.

-

The star is part of four reversal patterns:

- The morning star

- The evening star

- The doji star

- The shooting star

Python code

def doji_star_support(data):

value_found = 100

doji_star = talib.CDLDOJISTAR(data.Open, data.High, data.Low, data.Close)

data.loc[(doji_star == value_found) & (data['remarks'].isna()), 'remarks'] = 'doji_star'

data.loc[(doji_star == value_found) & (data['support'].isna()), 'support'] = data.loc[doji_star == value_found, 'Low']

# print(data[doji_star == value_found])

def doji_star_resistance(data):

value_found = -100

doji_star = talib.CDLDOJISTAR(data.Open, data.High, data.Low, data.Close)

data.loc[(doji_star == value_found) & (data['remarks'].isna()), 'remarks'] = 'doji_star'

data.loc[(doji_star == value_found) & (data['resistance'].isna()), 'resistance'] = data.loc[doji_star == value_found, 'Low']

# print(data[doji_star == value_found])

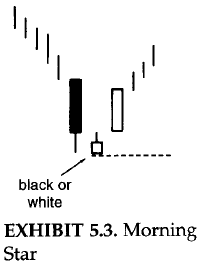

THE MORNING STAR

-

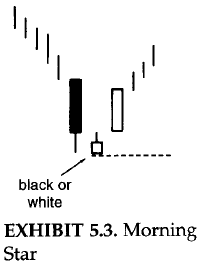

The morning star is a bottom reversal pattern. Its

name is derived because, like the morning star (the

nickname for the planet Mercury) that foretells the

sunrise, it indicates higher prices. There are three

candle lines comprising this pattern:

-

Candle 1: An extended black real body. This pictorially

proves that the bears are in command.

-

Candle 2: A small real body that doesn't touch the prior

real body (these two lines comprise a basic star pattern).

The small real body means sellers are losing the capacity

to drive the market lower.

-

Candle 3: The concluding candle of the morning star is a white

real body that intrudes deeply into the first session's black

candle. This is the indication that the bulls have seized control.

-

The lowest low of the three lines that form this pattern

should be support as hown by the dashed line.

-

An ideal morning star would have a gap between the second

and the third bodies. Although, a lack of gap does not seem

to weaken the power of this formation. The decisive factor

is that the second candle should be a spinning top and the

third candle pushes well into the black candle.

-

A limitation with the morning star is that since this is a three-candle

pattern, one has to wait until the close of the third session to

complete the pattern. As is usually the case, if this third candle is

a tall white one, we would get the signal well after the market already

had a sharp bounce. In other words, the completion of the morning star

may not present an attractive risk.reward trading opportunity. An option

is waiting for a correction to the morning star's support area to start

cautiously from the long side.

|

Morning Star

|

Python code

def morning_star(data):

value_found = 100

morning_star = talib.CDLMORNINGSTAR(data.Open, data.High, data.Low, data.Close)

data.loc[(morning_star == value_found) & (data['remarks'].isna()), 'remarks'] = 'morning_star'

data.loc[(morning_star == value_found) & (data['support'].isna()), 'support'] = data.loc[morning_star == value_found, 'Low']

# print(data[morning_star == value_found])

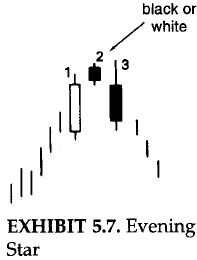

THE EVENING STAR

-

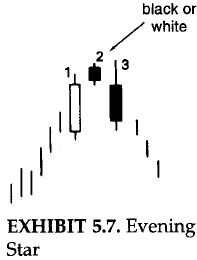

The evening star is the bearish counterpart of the morning star

pattern. It is named so because the evening star (the nickname

for the planet Venus) appears just before darkness sets in. Since

the evening star is a top reversal, it should be acted upon if it

arises after an uptrend.

-

Three lines compose the evening star:

-

The first is a long white body.

-

The next is a star. The star is the first hint of a top.

-

The third line corroborates a top and completes the three-line

pattern of the evening star.The third line is a black body that

closes sharply into the first period's white real body.

-

Evening star pattern is analogous to a traffic light. The traffic

light goes from green (the bullish white body) to yellow (the star's

warning signal) to red (the black real body confirming the prior trend

has stopped).

-

An evening star should have a gap between the first and the second real bodies

and then another gap between the second and the third real bodies. But, this

second gap is rarely seen and is not necessary for the success of this pattern.

The main concern should be the extent of the intrusion of the third day's black

real body into the first day's white body.

-

Some factors increasing the likelihood that an evening or morning star could be

a reversal would include:

-

If there is no overlap among the first, second, and the third real bodies.

-

If the third candle closes deeply into the first candle's real body.

-

If there is light volume on the first candle session and heavy volume on

the third candle session. This would show a reduction of the force for

the prior trend and an increase in the direction force of the new trend.

-

The highs of the evening star become resistance as displayed by the dashed line.

|

Evening Star

|

Python code

def evening_star(data):

value_found = -100

evening_star = talib.CDLEVENINGSTAR(data.Open, data.High, data.Low, data.Close)

data.loc[(evening_star == value_found) & (data['remarks'].isna()), 'remarks'] = 'evening_star'

data.loc[(evening_star == value_found) & (data['resistance'].isna()), 'resistance'] = data.loc[evening_star == value_found, 'Low']

# print(data[evening_star == value_found])

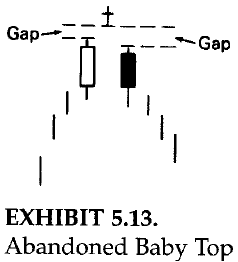

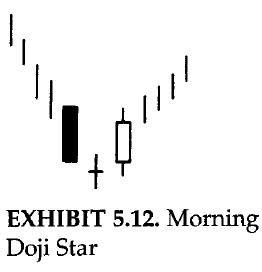

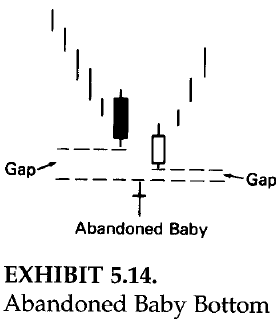

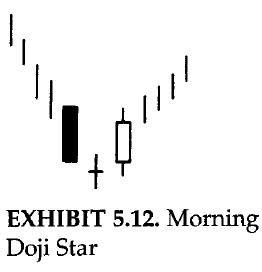

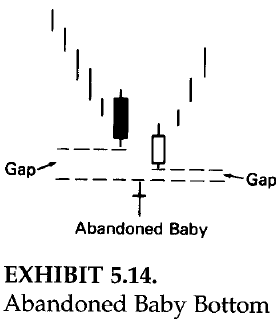

THE MORNING AND EVENING DOJI STARS

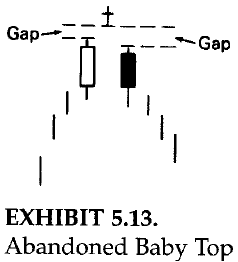

-

The evening doji star is a distinctive form of the regular evening star.

It has a doji instead of a small real body as the second candle.

-

If there is an evening doji star in which the bottom shadow of the doji session

does not overlap with the shadows of the first or third candles (that is, the

shadows do not touch), it is considered a top reversal signal known as an

abandoned baby top. Thus pattern is very rare.

|

Evening Doji Star

|

Abandoned Baby Top

|

-

The morning doji star has a doji as star portion. This type of morning star

can be a menaingful bottom.

-

If there is a doji that has a gap before and after it (where the shadows do not

touch), it should be a bottom. This pattern is referred to as an abandoned baby

bottom. It is also extremly rare.

|

Morning Doji Star

|

Abandoned Baby Bottom

|

Python code

def abandoned_baby_top(data):

value_found = -100

abandoned_baby_top = talib.CDLABANDONEDBABY(data.Open, data.High, data.Low, data.Close)

data.loc[(abandoned_baby_top == value_found) & (data['remarks'].isna()), 'remarks'] = 'abandoned_baby_top'

data.loc[(abandoned_baby_top == value_found) & (data['resistance'].isna()), 'resistance'] = data.loc[abandoned_baby_top == value_found, 'Low']

# print(data[abandoned_baby_top == value_found])

def abandoned_baby_bottom(data):

value_found = 100

abandoned_baby_bottom = talib.CDLABANDONEDBABY(data.Open, data.High, data.Low, data.Close)

data.loc[(abandoned_baby_bottom == value_found) & (data['remarks'].isna()), 'remarks'] = 'abandoned_baby_bottom'

data.loc[(abandoned_baby_bottom == value_found) & (data['support'].isna()), 'support'] = data.loc[abandoned_baby_bottom == value_found, 'Low']

# print(data[abandoned_baby_bottom == value_found])

def morning_doji_star(data):

value_found = 100

morning_doji_star = talib.CDLMORNINGDOJISTAR(data.Open, data.High, data.Low, data.Close)

data.loc[(morning_doji_star == value_found) & (data['remarks'].isna()), 'remarks'] = 'morning_doji_star'

data.loc[(morning_doji_star == value_found) & (data['support'].isna()), 'support'] = data.loc[morning_doji_star == value_found, 'Low']

# print(data[morning_doji_star == value_found])

def evening_doji_star(data):

value_found = -100

evening_doji_star = talib.CDLEVENINGSTAR(data.Open, data.High, data.Low, data.Close)

data.loc[(evening_doji_star == value_found) & (data['remarks'].isna()), 'remarks'] = 'evening_doji_star'

data.loc[(evening_doji_star == value_found) & (data['resistance'].isna()), 'resistance'] = data.loc[evening_doji_star == value_found, 'Low']

# print(data[evening_doji_star == value_found])

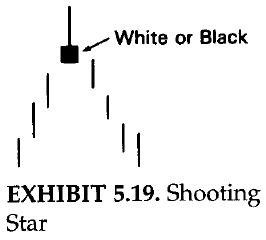

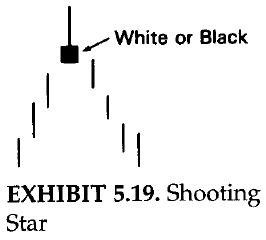

THE SHOOTING STAR AND THE INVERTED HAMMER

-

The shooting star- has a small real body at the lower end of

its range with a long upper shadow. We can see how this line's name

is derived. It looks like a shooting star with its long tail blazing

across the sky. The Japanese say that the shooting star shows trouble

overhead.

-

Since it is one session, it is usually not a major reversal signal as

is the bearish engulfing pattern or evening star. The shooting star

does not shows resistance unlike the bearish engulfing pattern or evening

star.

-

The shooting star is a bearish reversal signal, it must come after a rally.

An ideal shooting star has a real body that gaps away from the prior real

body. Nonetheless, as will be seen in several chart examples, this gap is not

always necessary. A lack of rising gap is more of a reason to be negative on

the shooting star. The trend could be turning less bullish if the shooting

star has no gap.

-

When we get signal after signal at the same price level, it reinforces that

resistance area. The occurrence of multiple shooting stars increases the

likelihood that this would be a reversal.

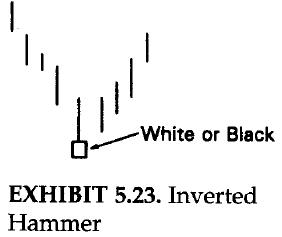

-

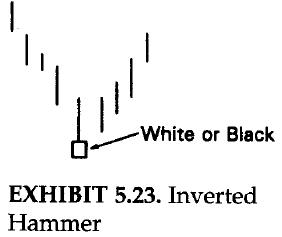

If a shooting star-shaped candle line comes after a downturn, it could be a bullish

signal. Such a line is called an inverted hammer. Although the inverted hammer has

the same form as a shooting star, it is not a star pattern.

|

Shooting Star

|

Inverted Hammer

|

-

Inverted hammer has the same form as a shooring star with its long upper shadow and

small real body at the lower end of the range. The only difference between the shooting

star and inverted hammer is that the inverted comes after a decline. As, a result while

the shooting star is a top reversal line, the inverted hammer is a bottom reversal line.

The colour of the inverted hammer's real body doesn't matter. This concept is similar to

the hammer and the hanging man concept in which the same shape line is bullish or bearish

depending on the preceeding trend.

-

Just as a hanging man needs bearish confirmation, the inverted hammer needs bullish confirmation.

This confirmation could be in the form of the next day opening above the inverted hammer's real

body or especially a close the next day over the inverted hammer's real body. The reason for

the required bullish verification of the inverted hammer is because its long upper shadow gives

the inverted hammer a bearish hue. To be aware of the inverted hammer session, the market opens on,

or near, its low and then rallies. The bulls fail to sustain the rally and prices close at, or near,

the lows of the session. If the next day opens, and especially closes, over the inverted hammer's real

body, the more likely these shorts will cover. This cold spark a short covering rally that could lead

to bottom pickers going long. This could feed upon itself with the result being the beginning of a rally.

Python code

def shooting_star(data):

value_found = -100

shooting_star = talib.CDLSHOOTINGSTAR(data.Open, data.High, data.Low, data.Close)

data.loc[(shooting_star == value_found) & (data['remarks'].isna()), 'remarks'] = 'shooting_star'

data.loc[(shooting_star == value_found) & (data['resistance'].isna()), 'resistance'] = data.loc[shooting_star == value_found, 'Low']

# print(data[shooting_star == value_found])

def inverted_hammer(data):

value_found = 100

inverted_hammer = talib.CDLINVERTEDHAMMER(data.Open, data.High, data.Low, data.Close)

data.loc[(inverted_hammer == value_found) & (data['remarks'].isna()), 'remarks'] = 'inverted_hammer'

data.loc[(inverted_hammer == value_found) & (data['support'].isna()), 'support'] = data.loc[inverted_hammer == value_found, 'Low']

# print(data[inverted_hammer == value_found])

LESS POWERFUL REVERSAL SIGNALS

Not always less powerful patterns such as: harami pattern, tweezers top and bottoms,

belt-hold lines, the upside-gap two crows, and counterattack lines, three black crows, three

mountains, three rivers, dumpling tops, fry-pan bottoms, and tower tops and bottoms.

Python code

def less_powerful_trend_reversal(data):

harami_cross(data)

harami_pattern(data)

belt_hold_lines(data)

upside_two_crows(data)

three_black_crows(data)

three_advancing_white_soliders(data)

counter_attack_lines(data)

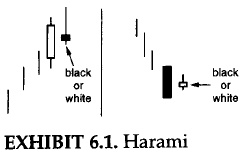

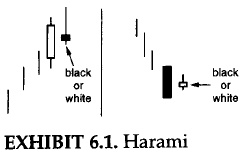

THE HARAMI PATTERN

-

Spinning tops (that is, small real bodies) are components in certain formations. The

harami is one of these formations (the star, examined earlier, is another). The

harami pattern is a small real body that is contained within what the Japanese call

"an unusually long black or white real body."

-

"Harami" is an old Japanese word for pregnant. The Japanese nickname for the long

candle is the "mother" candle and the small is the "baby" or "fetus". The second

candle of the harami can be white or black. If, for example, both the first and

second candles of the harami are white, it would be expressed as "white-white harami".

-

The Japanese will say that with a harami the market is "loosing its breadth". The

bearish harami displays a disparity about the market's health. Specifically after

a bull move, the long white real body's vitality is followed by the small real body's

uncertainity. Additionally, the small real body opening and closing within the prior

open-close range is another indication that the bulls' upward drive has weekened. Thus,

a trend reversal is possible.

|

The Harami Pattern

|

-

During a bear move, the selling force reflected by a long black real body is followed by the

second day's inability to decide actions. This could be a sign that a possibility of trend

reversal since the second day's small real body is an alert that the bears' power has dimished.

The combination of candle lines in the harami pattern, with its first tall real body followed

by a small real body, is the reverse of the engulfing pattern. In the engulfing pattern, a

lengthy real body engulfs the preceding small real body. Another difference between the harami

and engulfing pattern is that for the two candles of the engulfing pattern, the colour of the

real bodies should be opposite. This is not necessary for the harami. However, in most instances,

the real bodies in the harami pattern are oppositely coloured.

-

The entire range of the second session may not be within range of the first session. For harami

all that is required is that the second real body be within the first real body, even if the

shadow of the second day is above or below the prior day's high and low. In the figure (left side)

shown in this section, on the second session the upper shadow moved over the prior white real body.

This is still a harami because the second session's real body was contained within the first real

body.

Python code

def harami_pattern(data):

value_found = 100

harami_pattern = talib.CDLHARAMI(data.Open, data.High, data.Low, data.Close)

data.loc[(harami_pattern == value_found) & (data['remarks'].isna()), 'remarks'] = 'harami_pattern'

data.loc[(harami_pattern == value_found) & (data['support'].isna()), 'support'] = data.loc[harami_pattern == value_found, 'Low']

value_found = -100

data.loc[(harami_pattern == value_found) & (data['remarks'].isna()), 'remarks'] = 'harami_pattern'

data.loc[(harami_pattern == value_found) & (data['resistance'].isna()), 'resistance'] = data.loc[harami_pattern == value_found, 'Low']

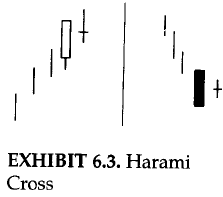

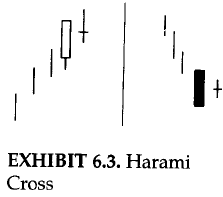

HARAMI CROSS

-

The regular harami has a tall real body followed by a small real body. Yet, there are no rules as to what

is considered "small" candle. This, like many other charting techniques, is subjective. A the general

principle, the more diminutive the second real body, the more potent the pattern. This is usually true

because the smaller the real body, the greater the ambivalence and the more likely a trend reversal. In

the extremes, as the real body becomes smaller as the spread between the open and close narrows, a doji

is formed. Doji preceded by a long blackreal body during a decline (or a tall white real body during a rally)

is distinctive type of harami reffered to as a harami cross.

-

The harami cross, becasue it contains a doji, is viewed as a strong reversal signal than the regular

harami pattern by the Japanese. The harami cross is sometimes referred to as the petrifying pattern.

The best way to justify this name is that the preceeding trend has been frozen or petrified in

preparation for a reverse move. A harami cross occuring after a very long white candle is a pattern

a long trader ignores at his or her own peril. Harami cross can also call bottoms, but they seem more

efffective at tops.

|

Harami cross

|

Python code

def harami_cross(data):

value_found = 100

harami_cross = talib.CDLHARAMICROSS(data.Open, data.High, data.Low, data.Close)

data.loc[(harami_cross == value_found) & (data['remarks'].isna()), 'remarks'] = 'harami_cross'

data.loc[(harami_cross == value_found) & (data['support'].isna()), 'support'] = data.loc[harami_cross == value_found, 'Low']

value_found = -100

data.loc[(harami_cross == value_found) & (data['remarks'].isna()), 'remarks'] = 'harami_cross'

data.loc[(harami_cross == value_found) & (data['resistance'].isna()), 'resistance'] = data.loc[harami_cross == value_found, 'Low']

# print(data.loc[(harami_cross == value_found) | (harami_cross == -value_found)])

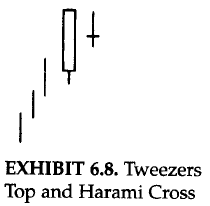

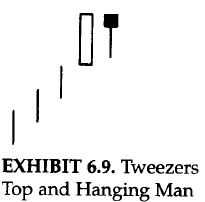

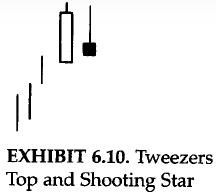

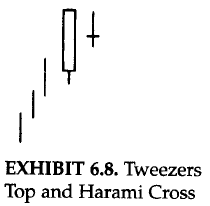

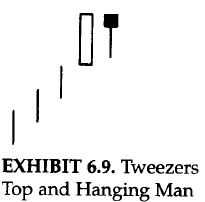

TWEEZERS TOP AND BOTTOMS

-

Tweezers are two or more candle lines with matching highs or lows. They are called tweezers tops and

tweezers bottoms because they are compared to the two prongs of a tweezers. In a rising market, a

tweezers top is formed when the two or more consecutive highs match. In a falling market, a tweezers

bottom is made when two or more successive lows are the same. The tweezers could be composed of real

bodies, shadows, and/or doji. Ideally the tweezers should have a long first candle and a small real

body as the next session. This shows that whatever force the market had on the first session (bullish

force with a long white candle and bearish force with a long black candle), it was dissolving with the

following small real body with the same high (for a tweezers top) or same low (top a tweezers bottom).

If there is a bearish (for a top reversal) or a bullish (for a bottom reversal) candle signal that is

also a tweezers top, it adds more importance to the pattern.

|

Tweezers top and harami cross

|

Tweezers top and hanging man

|

-

Tweezers top and harami cross- shows how, during an ascent, a long white line is

followed by a doji. This two-candle pattern, a harami cross with the same high,

can be a significant warning.

-

Tweezers Top and Hanging Man- The figure illustrates a tweezers top formed by

a long white candle and a hanging man line. If the market opens, and especially closes,

under the hanging man's real body, odds are strong that a top has been reached. This

two-line mixture can also be considered a harami. As such, it would be a top reversal

pattern during an uptrend.

-

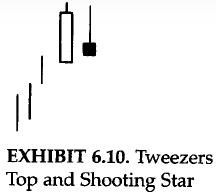

Tweezers Top and Shooting Star- illustrates a tweezers top joined with the second

period's bearish shooting star line.

-

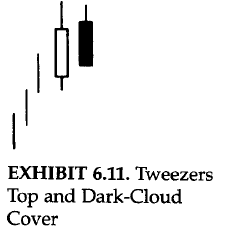

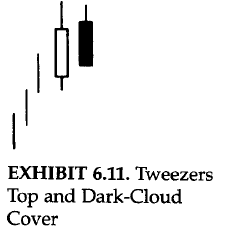

Tweezers Top and Dark-Cloud Cover- an ideal tweezers would have as its second session

not only the same high, but also a small real body. In the figure, the second candle is not a

small real body. However, this second session completes a variation on the dark-cloud cover

(the second day opens above the prior day's close instead of above the prior day's high). The

black candle session's high also just touches the prior period's high and then falls. Because

of this last fact- i.e.m both sessions have the same highs- it adds more negative impact to this

variation of the dark-cloud cover.

|

Tweezers top and shooting star

|

Tweezers top and dark could cover

|

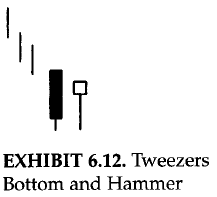

-

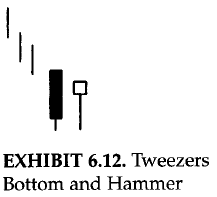

Tweezers Bottom and Hammer- The figure shows a hammes session that successfully tests the

prior long black candlesticks's lows. The hammer, and the successfullytest of support, proves that

the sellers are losing control of the market. This two-line combinationis also a harami. This would

be another reason to view this action as support.

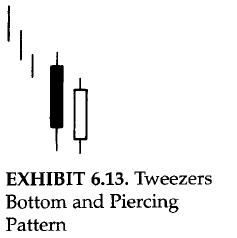

-

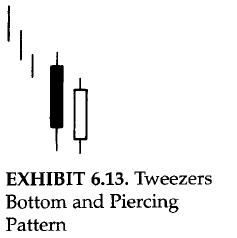

Tweezers bottom and piercing pattern- In the figure shown, while it doesn't have a small body

for the second candle, does complete a variation on the bullish piercing line. (A true piercing line

would open under the prior day's low. Here it opened under the prior day's close.) Because of this I

view it also as a tweezers bottom.

-

These examples of tweezers are not inclusive. They are representative of how top and bottom tweezers

should be confirmed by other candlestick indications so as to be valuable forecasting tools.

|

Tweezers bottom and hammer

|

Tweezers bottom and piercing pattern

|

-

Tweezers should be viewed differently for daily, intraday, and weekly or long charts. This is because

there is nothing influential about having the same highs or lows for two daily or intraday sessions. It's

only if these sessions also meet the specific criteria for a tweezers (the first long, the second short, or

a candle pattern with the same highs or same lows) does it warrant attention. As such, the main aspect to

keep in mind with tweezers on a daily or intraday chart is that it takes a special combination of candle

lines to warrent acting upon tweezers.

-

For those who want a longer time perspective, tweezers tops and bottoms on the weekly and monthly candlestick

charts made by consecutive candlesticks could be important reversal patterns. This would be true even without

other candle confirmations becasue, on a weekly or monthly chart, for example, a weekly low this week that

successfully holds last week's lows could be a base for a rally. The same can't be said of daily or intraday

lows.

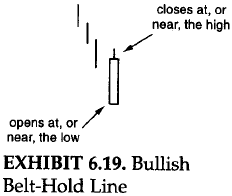

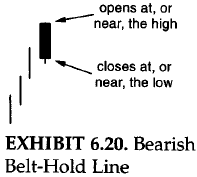

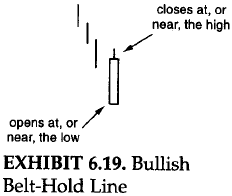

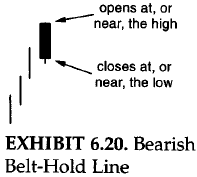

BELT-HOLD LINES

-

The belt-hold is an individual candle line. The bullish belt-hold is a strong white candle that opens

on the low of the session (or with a very small lower shadow) and closes at, or near, the session highs.

The bullish belt-hold line is also called a white opening shaven bottom. If it is at a low price area

and a long bullish belt-hold appears, it forecasts a rally.

-

The bearish belt-hold is a long black candle that opens on the high of the session (on within a few ticks

of the high) and continues lower through the session. If prices are high, the appearance of a bearish

belt-hold is a top reversal. The bearish belt-hold line is sometimes called a black opening shaven head.

-

The longer the height of the belt-hold candle line, the more significant it becomes. The actual Japanese

name for the belt-hold is a sumo wrestling term, yorikiri, which means "pushing your opponent out of the

ring while holding onto his belt".

-

A close above a black bearish belt-hold line should mean a resumption of the uptrend. A close under the

white bullish belt-hold line implies a renewal of selling pressure. Belt-hold lines are more important

if they confirm resistance or other belt-hold lines or if they have not appeared for a while.

|

Bullish belt hold line

|

Bearish belt hold line

|

Python code

def belt_hold_lines(data):

value_found = 100

belt_hold_lines = talib.CDLBELTHOLD(data.Open, data.High, data.Low, data.Close)

data.loc[(belt_hold_lines == value_found) & (data['remarks'].isna()), 'remarks'] = 'belt_hold_lines'

data.loc[(belt_hold_lines == value_found) & (data['support'].isna()), 'support'] = data.loc[belt_hold_lines == value_found, 'Low']

value_found = -100

data.loc[(belt_hold_lines == value_found) & (data['remarks'].isna()), 'remarks'] = 'belt_hold_lines'

data.loc[(belt_hold_lines == value_found) & (data['resistance'].isna()), 'resistance'] = data.loc[belt_hold_lines == value_found, 'Low']

# print(data.loc[(belt_hold_lines == value_found) | (belt_hold_lines == -value_found)])

UPSIDE-GAP TWO CROWS

-

An upside-gap two crows (shown in the adjecent figure) is very rare. The upside-gap refers to the gap between

the real body of the small black real body and the real body preceding it. (The real body that precedes the first

black candle is usually a long white one.) The two black candles are the "crows" in this pattern. They are analogous

to black crows peering down ominously from a tree branch. Based on this portentous (bombastic) comparision, it is

obviously a bearish pattern. An ideal upside-gap two crows has the second black real body opening above the first

black real body's open. It then closes under the first black candle's close.

-

The rationale for the bearish aspect of this pattern is as follows:

-

The market is in an uptrend and gaps higher on the open.

-

The new highs fail to hold and the market forms a black candle.

-

But the bulls can take over some support in hardship, at least, because the close on this black candle sesion

still hlds above the prior day's close.

-

The third session paints a more bearish portrait with another new high and another failure to hold these highs

into the close. More negative, however, is that this session closes under the prior day's close. If the market

is so strong, why did the new highs fail to hold and why did the market close lower? Those are the questions

that the bulls are probably nervously asking themselves. The answers might be that the market may not be so strong

as they would like. If prices fail to regain high ground the next day (that is, the fourth session), then expect

lower prices.

|

Upside gap two crows

|

Python code

def upside_two_crows(data):

value_found = -100

upside_two_crows = talib.CDLUPSIDEGAP2CROWS(data.Open, data.High, data.Low, data.Close)

data.loc[(upside_two_crows == value_found) & (data['remarks'].isna()), 'remarks'] = 'upside_two_crows'

data.loc[(upside_two_crows == value_found) & (data['resistance'].isna()), 'resistance'] = data.loc[upside_two_crows == value_found, 'Low']

# print(data.loc[(upside_two_crows == value_found) | (upside_two_crows == value_found)])

THREE BLACK CROWS

-

The upside-gap two crows consists of two black candles. If there are three declining consecutive black candles, it is called

three black crows pattern. The three black crows indicate lower prices if they appear at high price levels or after a mature

advance. Three crows are also sometimes called three-winged crows. The Japanese have an rxpression, "Bad news has wings".

-

This is an appropriate saying for the three-winges crow pattern. The three crows are, as the name implies, three black candles.

Likened to the image of a group of crows sitting ominously in a tall dead tree, the three crows have bearish implications. The

three lines should close at, or near, their lows. Ideally, each of the openings should also be within the prior session's real

body.

-

The three black crows would likely be useful for longer-term traders. This is because this patter is completed on the third black

candle. Obviously, by the tim this occurs the market has already substantially corrected.

|

Three black crows

|

Python code

def three_black_crows(data):

value_found = -100

three_black_crows = talib.CDL3BLACKCROWS(data.Open, data.High, data.Low, data.Close)

data.loc[(three_black_crows == value_found) & (data['remarks'].isna()), 'remarks'] = 'three_black_crows'

data.loc[(three_black_crows == value_found) & (data['resistance'].isna()), 'resistance'] = data.loc[three_black_crows == value_found, 'Low']

# print(data.loc[(three_black_crows == value_found) | (three_black_crows == value_found)])

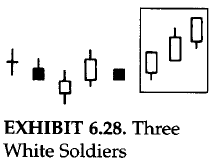

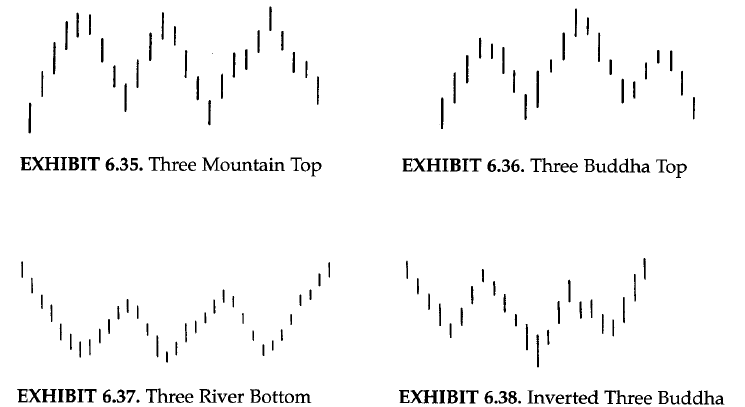

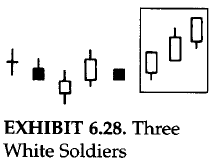

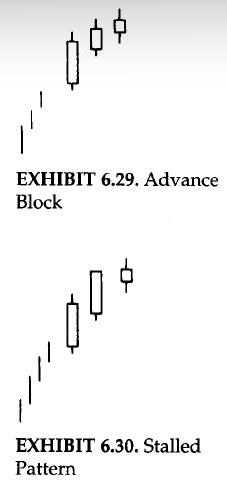

THREE ADVANCING WHITE SOLIDERS

-

The opposite of the three black crows is three advancing white soliders or, more commonly, three white soliders. Like much

of the candle terminology, this pattern has a military association. It is a group of three long white candles with consecutively

higher closes. If this pattern appears at low price area or after a period of stable prices, then it is a sign of strength ahead.

The three white soliders are a gradual and steady rise with each white line opening within or near the prior session's white real

body. Each of the white candles should close at, or near, its highs. It is a healthy method for the market to rise (although if

the white candles are very extended, one should be catious about an overbought market).

|

|

-

If the second and the third or just candle shows signs of weakening, it is an advance block pattern. This means the rally is

running into trouble and longs should protect themselves. Be especially cautious about this pattern during a mature uptrend.

Signs of weakening could be progressively smaller white real bodies or relatively long upper shadows.

-

If the last two candles are long white ones that make a new high followed by a small white candle, it is called a stalled

pattern. It is also sometimes called a deliberation pattern. The bulls' strength has been at least temporarily exhausted

after this formation. This last small white candle can either gap away from the long white body (in which case it becomes

a star) or it can be, as Japanese express it, "riding on the shoulder" of the long white body (i.e., be at the upper end

of the prior long white real body). The small real body discloses a deterioration of the bulls' power.

-

Although the advance block and stalled patterns are not normally top reversal patterns, they can sometimes precede a

price decline.The advance block and stalled patterns should be used to liquidate or protect longs, but usually not to

short. They are generally more consequential at higher price levels. These patterns can be at low price area or

during a rally.

-

There is not much difference between the advanced block and stalled pattern. The main factor to consider with three

white soliders is that it is most constructive for each of the three candles to close at or near its highs. If the

latter two white candles shows signs of hesitation, either with small real bodies or uppper shadows, then it is a

clue that the rally is losing force.

-

It id found that on corrections, the first or second white candle that started hte three white soliders is often

support.

-

The market sometimes correct after the three white soliders. We should expect support as the stock gets to the

second, or especially the first, white solider.

|

|

Python code

def three_advancing_white_soliders(data):

value_found = 100

three_advancing_white_soliders = talib.CDL3WHITESOLDIERS(data.Open, data.High, data.Low, data.Close)

data.loc[(three_advancing_white_soliders == value_found) & (data['remarks'].isna()), 'remarks'] = 'three_advancing_white_soliders'

data.loc[(three_advancing_white_soliders == value_found) & (data['support'].isna()), 'support'] = data.loc[three_advancing_white_soliders == value_found, 'Low']

# print(data.loc[(three_advancing_white_soliders == value_found) | (three_advancing_white_soliders == value_found)])

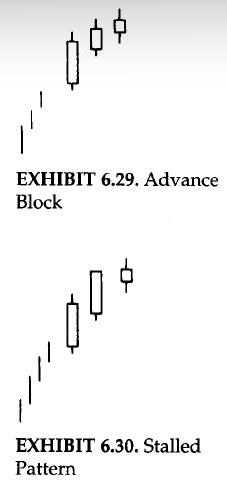

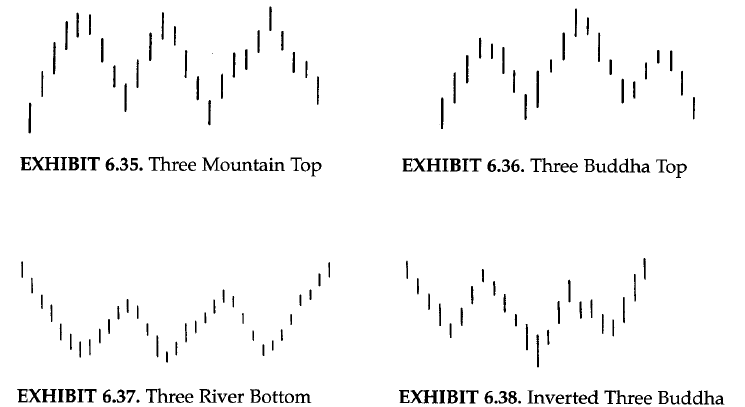

THREE MOUNTAINS AND THREE RIVERS

-

There is a group of longer-term topping and bottoming pattern that include the three moauntain, three rivers, the three

Buddha tops, inverted three Buddha, dumpling tops, fry-pan bottoms, and tower tops and bottoms.

-

Three mountain top is supposed to represent a major top. If the market backs off from a high three times or makes three

attempts at a high, it is deemed a three mountain top. The high point of the final mountain ideally should be confirmed

with a bearish candle indicator (for example, a doji or dark-cloud cover). If the central mountain of a three mountain

top is the highest mountain, it is a special type of three mountain called a three Buddha top. The reason for this name

is because, in Buddhist temples, there is a large central Buddha with smaller Buddhas (i.e., saints) on both sides. This

is the same pattern as the West's head and shoulders top.

-

Although the three Buddha top is analogous to the Western head and shoulders pattern, the theory about the japanese three

Buddha pattern was used over a hundred years before the head and shoulders was known in America. (The earliest reference

seen to a head and shoulders pattern in the United States was by Richard Schabaker in the 1930s).

-

It is intriguing how market observers from both the West and the East have come up with this same pattern. Market

psychology is the same around the world, or, as a Japanese proverb expresses, "The tone of a bird's song is the same

everywhere".

-

The three river bottom pattern is the opposite of the three mountain top. This occurs when the market tests a bottom level

three times. The peak of the troughs should be exceeded to confirm a bottom. The equivalent of the Western inverted head

and shoulders bottom is called, not surprisingly, an inverted three Buddha.

-

The peaks of each mountain were almost the same. This is not necessary. It is still considered a three mountain top if

the three price peaks are not exactly at the same highs. If A, B, and C are three peaks where B and C are slightly higher

levels. This would still be considered a three mountain top.

|

|

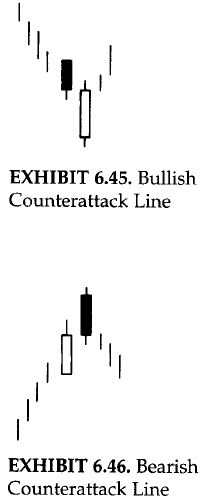

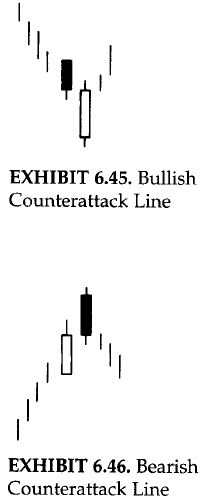

COUNTERATTACK LINES

-

Counterattack lines are formed when opposite coloured candles have the same close. The best way to describe this pattern is

by discussing the illustrations on the right-side of this section. The figure above is an example of a bullish counterattack

line. This pattern occurs during a decline. The first candle of this pattern is usually a long black candle. The next session

opens sharply lower. At this point, the bears are feeling confident. The bulls then stage their counterattack as they push

prices back up to unchanged from the prior close. The prior downtrend has then been suspended.

-

The bullish counterattack is comparable to the bullish piercing line. If you remember, the piercing line has the same

two-candle configuration as that shown for the bullish counterattack pattern. The main differnece is that the bullish

counterattack line does not move into the prior session's white real body. It just gets back to the prior session's

close. The piercing pattern's second line pushes well into the black real body. Consequently, the piercing pattern is

a more significant bottom reversal than is the bullish counterattack line. Nonetheless, as shown in same examples below,

the bullish counterattack line should be respected, since it proves that there is a change in the flow of direction of

the market.

-

The figure below is the bullish counterattack line is the bearish counterattack line. The first candle, a long white one,

keeps the bullish momentum going. The next session's opening gaps higher. The longs are happy then the bears come out

fighting and pull prices to the prior day's close. The bulls' tide of optimism on the second day's opening probably turned

to apprehension by the close. As the bullish counterattack line is rlated to the piercing line, so the bearish counterattack

line is related to the dark-cloud cover. The bearish counterattack line is realted to the dark-cloud cover. The bearish

counteratack, like the dark-cloud cover, should ideally open above the prior day's high. Unlike the dark-cloud cover, though,

the close does not go into the prior day's white candle. Thus, the dark-cloud cover sends a stronger top reversal signal than

does the bearish counterattack line.

-

An important consideration of the counterattack lines is that second session should open robustly higher (in the case of the

bearish counterattack) or sharply lower (for the bullish counterattack). The idea is that on the opening of the second day of

this pattern, the market has moved slightly in the direction of the original trend. Then, by the close, it moves back to unchanged

from the prior session. In doing so, it changes the market's texture in one day.

-

A mentioned in the secion of three black crows, becasue we need to wait for three black candles for the completion of

that signal, much of the move may be lost bt the time the third candle of the three black crows unfolds. In this case,

however, eith the first black candle's counterattack line, we would have received an early tirning signal in one session

that was further confirmed with the three black crows.

|

|

Python code

def counter_attack_lines(data):

value_found = 100

found_value = talib.CDLCOUNTERATTACK(data.Open, data.High, data.Low, data.Close)

data.loc[(found_value == value_found) & (data['remarks'].isna()), 'remarks'] = 'counter_attack_lines'

data.loc[(found_value == value_found) & (data['support'].isna()), 'support'] = data.loc[found_value == value_found, 'Low']

value_found = -100

data.loc[(found_value == value_found) & (data['remarks'].isna()), 'remarks'] = 'counter_attack_lines'

data.loc[(found_value == value_found) & (data['resistance'].isna()), 'resistance'] = data.loc[found_value == value_found, 'Low']

# print(data.loc[(found_value == value_found) | (found_value == -value_found)])

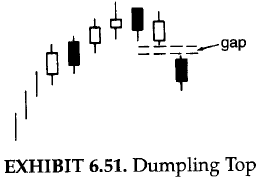

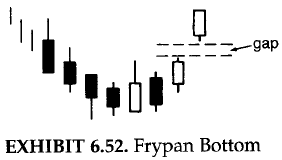

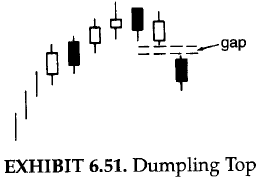

DUMPLING TOPS AND FRYPAN BOTTOMS

-

The dumpling top is a top reversal that usually has a small real bodies as the market forms a convex pattern. Confirmation

of the dumpling top is when the market gaps down. This pattern is the same as the Western rounded top. The only difference

is that the dumpling top has the extra bearish kicker of a gap lower. (A gap down is called a "falling window" in candle

terminology.)

-

The market is ascending with higher highs and goes into a period where the highs are the same, and then goes to lower highs.

As such, the pace of the rally is slackening. Then when you have a gap down to complete the dumpling top, it just puts another

nail in the bulls' coffin.

|

|

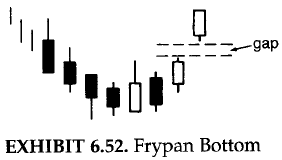

-

The frypan bottom reflects a market that is bottoming and whose price action forms a concave design and then opens a gap to

the upside (i.e., a rising window). It has the same appearance as a Western rounded bottom, but the Japanese frypan bottom

must have a gap higher to confirm this pattern. With the frypan bottom, the market goes from lower lows to the same lows and

then higher lows.

-

This pictorially proves that the bears are losing a foothold. Then, when you add a rising gap to this scenario, it gives even

more proof that the bears have lost control of the market. The Japanese will say that with a frypan bottom the parket becomes

"immune to bad news". As such, if a market builds a frypan bottom- especially in spite of bearish news- it would be very

impressive.

|

|

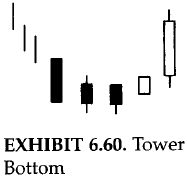

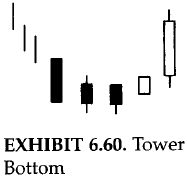

TOWER TOPS AND BOTTOMS

-

The tower top unfolds at high price levels. During a rally, there is a short-term lull (pause) after one or more white

candles. Then one or more large candles emerge. This creates a top with a white and black "tower" on either side of the

small real bodies. That is, long candles on the way down and long candles on the way up.

-

Sometimes tower tops send out a signal late in the move (since we have to wait for a black candle).

|

|

-

The tower bottom occurs in a descending market in which one or more tall black candles keep the bearish momentum intact.

Then some small real bodies lessen the bearish tome and finally a tall white candle finalizes the tower bottom.

-

The closest Western comparison to the tower top and bottom would be the spike, or V, reversal. In the spike reversal, the

market is in a strong trend and then abruptly reserves to a new trend.

-

The tower top and bottom, like some other candlestick signals such as three black crows, may be most useful for longer-term

traders since the tower is often finalized late in the move.

-

The tower bottom is analogous to the frypan bottom while the tower top is similar to the dumpling top. The main distinction

between these two patterns is that long black and white candles are needed for the towers and there is no gap required. The

dumpling top and frypan bottom require gaps.

|

|

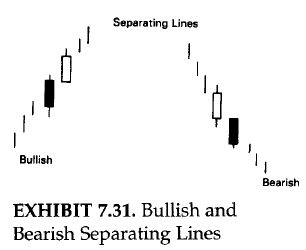

CONTINUATION PATTERNS

-

Most candle signals are trend reversals. There are , however, a group of candle patterns that are continuation indicators. A continuation

pattern is one in which the market should continue the same trend as that in force before the continuation pattern. For instance, a continuation

pattern following a rally means that the trend remains up and we should expect the rally to remain in force. (This, however, does not preclude a

correction after the continuation pattern before the rally, hopefully, unfolds.)

-

As the Japanese express it, "Thre are time to buy, times to sell, and times to rest". Many of these continuation patterns imply a time to

rest, a breather, before the market resumes its prior trend. The continuation formations reviewed in this chapter are windows (and patterns

that include windows), the rising and falling three methods, separating lines, and three white soliders.

Python code

def continuation_pattern(data):

tasuki_gap(data)

gap_side_by_side_white_lines(data)

rise_fall_three_method(data)

separating_lines(data)

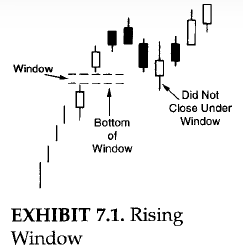

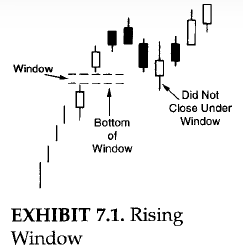

WINDOWS

-

The Japanese refer to what we call in the West a gap as a window. Whereas the Western expression is "filling in the gap",

the Japanese would say, "closing the window". There are two kinds of windows, one bullish and other bearish.

-

A rising window is a bullish signal. There is a price vacuum between the prior session's high (that is, the top of the upper

shadow) and the current session's low (e.g., the bottom of the lower shadow).

-

It is said by the Japanese technicians to "go in the dirrection of the window". This is because windows are continuation signals.

Consequently, with the emergence of a rising window, one should look to buy on dips, and with a falling window to sell on bounces.

-

It is also said by the Japanese that "corrections stop at the window". This means windows can become support and resistance

areas. Thus, a rising window (the entire window) should also be a zone of support on pullbacks. If the pullback closes under the

bottom of the window, the prior uptrend is voided. In the rising window figure, the market got under the bottom of the window,

but since it didn't close under this area, the rising windows support remains intact.

-

The entire rising window becomes a potential support zone. The disadvantage with a large window is that the whole zone

is potential support. Consequently, we don't have so tight a support (with a rising window) or resistance (with a falling

window) as one would have with a very small window.

-

If there are two windows. Window 1 and window 2, window 2 being at higher price levels. After window 2 is breached, the

window 1 becomes support. If a window support is broken, look for another window under the one that was broken as next

support area.

|

|

-

Falling window is a bearish signal in which there is a gap between the prior sesion's low and the current session's high.

-

Likewise, a falling window implies still lower levels. Any price rebounds should run into resistance at this falling

window (the entire window). If the bulls have enough force to close the market above the top of the falling window, the

downtrend is done.

-

There is a belief in the West that a gap is always filled. But as we have seen that corrections stop at a window, once

prices try to fill a gap we can then consider buying (in a rising window) or selling (in a falling window).

-

There is a common misunderstanding with windows that the real bodies don't touch. In case the shadows overlap, it is not a

window. So, no overlap between shadows is the main criteria for window. No matter how large the "gap" between the real bodies,

it is not a window unless there is a space between the shadows.

-

No matter how tiny a rising window, that window should be potential support. The same is true with a falling window as

resistance.

-

Size doesn't matter with windows. Although the rising window's support zone before bouncing. Therefore, if you are

aggressively bullish as a market approaches the rising window, you can consider buying as a market approaches the rising

window, you can consider buying even if it gets close to the top of the window. How one uses a window is dependent on

trading style and aggressiveness. There should be a stop (mental or otherwise) if the market clsoes under the bottom of

the rising window.

|

|

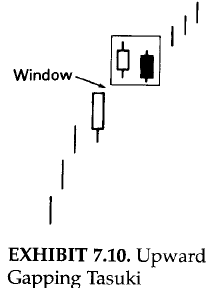

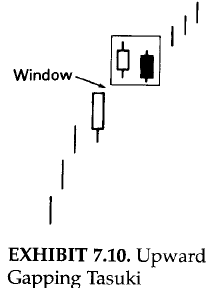

TASUKI

-

The tasuki are a specific combination of two candle lines that gap higher or lower.

-

The upward gapping tasuki is made of a rising window formed by a white candle and then a black candle. The black candle opens

within the white real body and closes under the white candle's real body. The close on the black candle day is the flight point.

If the market closes under the bottom of the window, the bullish outlook of the upward gap tasuki is voided.

-

It is the window itself that is critical. All one needs to remember is that if there is a rising window (such as the upward

tasuki), it is bullish signal and the window should be support. It does not matter what the candle lines look like after the

rising window. The main concern is looking at that rising window as support based on the close.

|

|

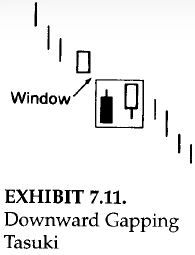

-

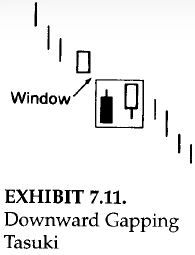

The same concept is true in reverse for a downward gapping tasuki. The market opens a falling window with a black candle

followed by a white candle. The two candles of the tasuki should be about the same size. Both types of tasuki are rare.

-

Since the downward gapping tasuki has a falling window, the window should be resistance. A close over the top of the falling

window would void the bearish implications of the downward gapping tasuki.

|

|

Python code

def tasuki_gap(data):

value_found = 100

found_value = talib.CDLTASUKIGAP(data.Open, data.High, data.Low, data.Close)

data.loc[(found_value == value_found) & (data['remarks'].isna()), 'remarks'] = 'tasuki_gap'

data.loc[(found_value == value_found) & (data['support'].isna()), 'support'] = data.loc[found_value == value_found, 'Low']

value_found = -100

data.loc[(found_value == value_found) & (data['remarks'].isna()), 'remarks'] = 'tasuki_gap'

data.loc[(found_value == value_found) & (data['resistance'].isna()), 'resistance'] = data.loc[found_value == value_found, 'Low']

# print(data.loc[(found_value == value_found) | (found_value == -value_found)])

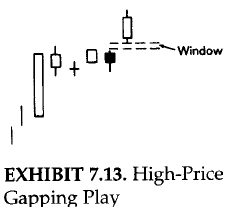

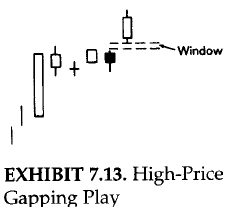

High-Price and Low-Price Gapping Plays

-

It is normal after a sharp advance for the market to consolidate the gains. Sometimes this consolidation is by a series of

small real bodies.

-

A group of small real bodies after a strong white session tells us that the market is undecided. These small real bodies,

while changing the trend from up to neutral, are in a sense healthy since, by treading water, the market is then relieving

its overbought condition.

-

If there is a rising window from these small real bodies, it is a bullish signal. This is the high-price gapping play pattern.

It is called this because prices hover near their recent highs and then gap to the upside.

|

|

-

A low-price gapping play is the bearish counterpart of the high-price gapping play. The low-price gapping play is a downside window

from a low-price congestion band. This congestion band (a series of small real bodies) initially stabilized a steep decline. At first,

this group of small candles gives the appearance that a base is forming. The break to the downside via a window dashes these bullish

hopes.

|

|

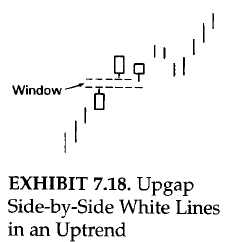

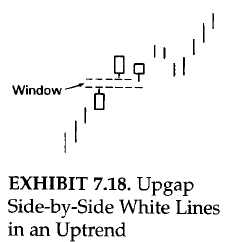

GAPPING SIDE-BY-SIDE WHITE LINES

-

In a rally, an upward-gapping white candle followed the next session by another similar-sized white candle with about the

same opening is a bullish continuation pattern. This two-candle pattern is refered to as upgap side-by-side white lines.

-

It is the window that is critical. The combination and colours of the candle lines after a rising or falling window pattern

aren't important. A falling window puts the trend up with the windows as support or resistance.

|

|

-

There are rarer side-by-side white lines that gap lower. These are called downgap side-by-side white lines.

-

In the figure, we can see that inspite of the dual white candles, it is still considered a bearish signal because of the

falling window. These white lines are viewed as short covering. Once this short covering evaporates, prices should move lower.

The reason the downgap side-by side white line pattern is especially rare is because black candles, not white candles, are

more natural in a declining price environment.

-

The candle lines that make the gapping side-by-side white candles are not critical to remember. What is important is

the rising and falling windows that are part of these patterns.

-

The pattern has minor consequence if there are two white candles (as with the side-by-side patterns) or a black and white

(as with the tasuki) after the window. It is the window itself that gives us the trend and the support or resistance area.

-

In the downgap side-by-side white candles, it is not surprising that this is a bearish signal in spite of the two white

candles. Thisis because it is the falling window of that pattern that defines the trend (in this case, down). It would

take a close over the top of the falling window to neagte the bearish outlook of the downgap side-by-side white lines.

|

|

Python code

def gap_side_by_side_white_lines(data):

value_found = 100

found_value = talib.CDLGAPSIDESIDEWHITE(data.Open, data.High, data.Low, data.Close)

data.loc[(found_value == value_found) & (data['remarks'].isna()), 'remarks'] = 'gap_side_by_side_white_lines'

data.loc[(found_value == value_found) & (data['support'].isna()), 'support'] = data.loc[found_value == value_found, 'Low']

value_found = -100

data.loc[(found_value == value_found) & (data['remarks'].isna()), 'remarks'] = 'gap_side_by_side_white_lines'

data.loc[(found_value == value_found) & (data['resistance'].isna()), 'resistance'] = data.loc[found_value == value_found, 'Low']

# print(data.loc[(found_value == value_found) | (found_value == -value_found)])

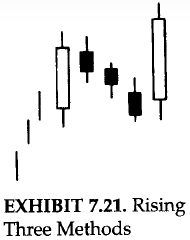

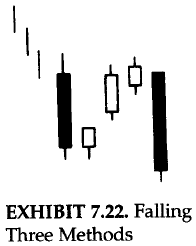

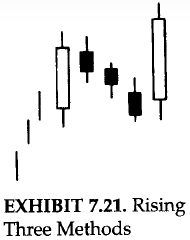

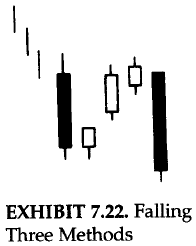

RISING AND FALLING THREE METHODS

-

The three methods include the bullish rising three methods and a bearish falling methods. These are both continuation patterns.

That is, the trend before the bullish rising three methods should continue higher once the bullish three methods is completed.

Likewise, a bear trend remains in effect after the bearish falling three methods.

-

The rising three methods is composed of:

-

A long white candle.

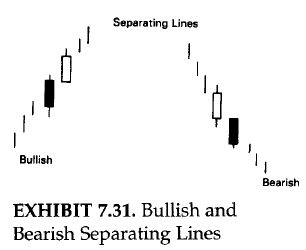

-